Court cases

Interstate Circuit, Inc. v. United States (1939)

- Texas Consolidated (an affiliate of Interstate) and Interstate Circuit were movie theater companies that had local monopolies on first-run movies in many cities throughout Texas and New Mexico

- The general manager of both companies sent a letter to all eight film distributors

- The letter included the name of all branch managers, a notice that all other branch managers received the letter, and commanded them to raise the evening price for an adult ticket to 25 cents

- All eight managers agreed to the terms of the letter

- The Supreme Court found Interstate guilty

- They ruled “it was enough that, knowing that concerted action was contemplated and invited, the distributors gave their adherence to the scheme and participated in it. Each distributor was advised that the others were asked to participate; each knew the cooperation was essential to successful operation of the plan”

- This set precedent that if one could infer agreements, then it’s enough to prosecute collusive behavior

- There was no evidence of a formal agreement; however, there seemed to be enough evidence of a conspiracy between members

E.I. Du Pont De Nemours & Co. v. FTC (1984)

- This case serves as the only major case to use preannouncements or pre-commitment strategies

- Du Pont and other major chemical firms produced a chemical used in gasoline

- The demand for these chemicals were declining, as unleaded gas became required

- The FTC noticed that prices were rising and inferred non-competitive behavior based on price preannouncements and most favored customer clauses

- The courts ruled there was not enough evidence of anticompetitive intent, and there was no explicit collusion

US v. International Harvesters Co. et al (1927)

- International Harvesters formed as a merger of five firms

- They exceeded 85% of market share for agricultural equipment

- The courts found this violated the Sherman Act

- They were forced to divest two of its manufacturing plants and alter its market strategies

- Later, it was observed that whenever International changed prices, all other manufacturers followed

- This was not deemed a violation, as the courts believed the reason for the price correlation was that firms were following the barometric firm in the market

Kleen Products LLC. Georgia Pacific LLC (2018)

- Kleen Products alleged several containerboard firms engaged in a price-fixing strategy within months of attending industry conferences in June and November 2005

- Most of the defendants settled

- Georgia-Pacific and WestRock did not settle and convinced the court there wasn’t enough evidence to proceed to trial

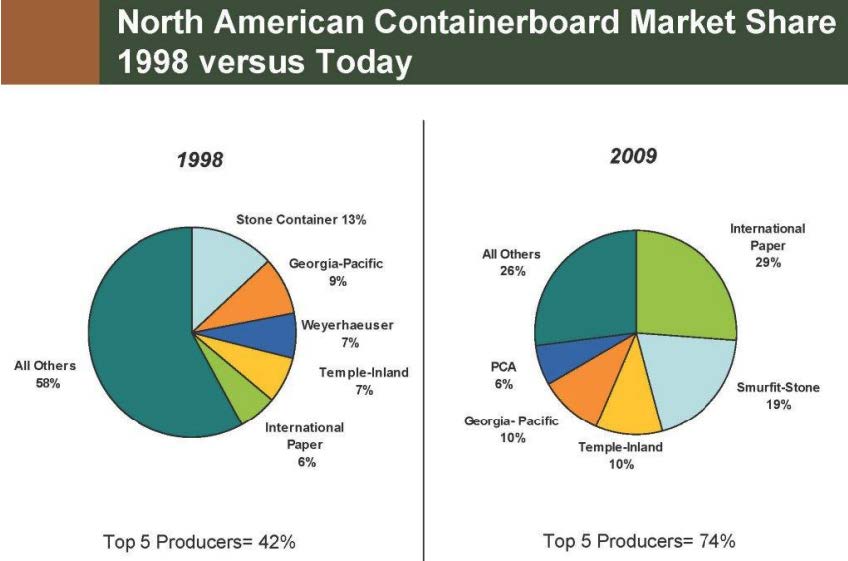

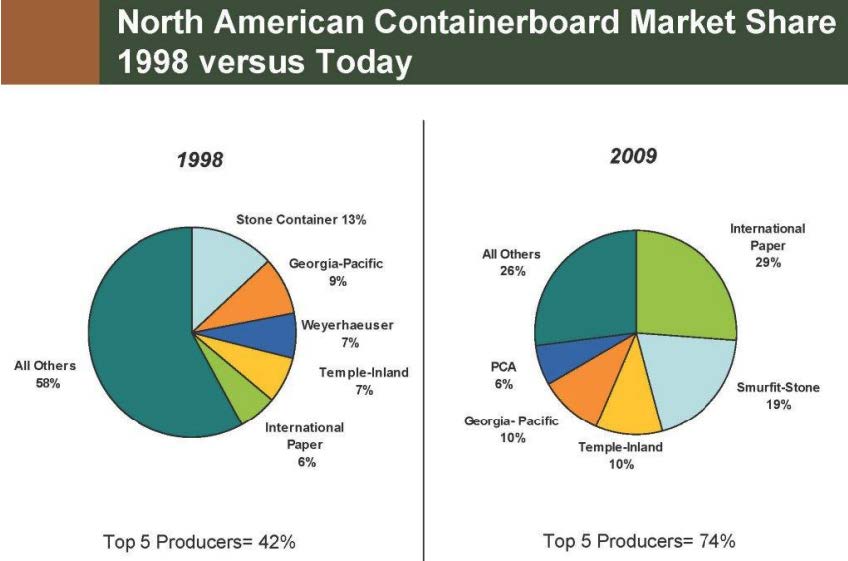

- Economic consultants for the plaintiff stated that the containerboard industry has characteristics that make it highly susceptible to horizontal price-fixing and output restrictions

- Entry is restricted, as the industry is very capital intensive

- There are no major substitutes for containerboard, and as a result demand is relatively inelastic

- Industry concentration has increased over the last several decades

- The courts ruled there wasn’t any evidence that the executives discussed price-fixing or output restrictions

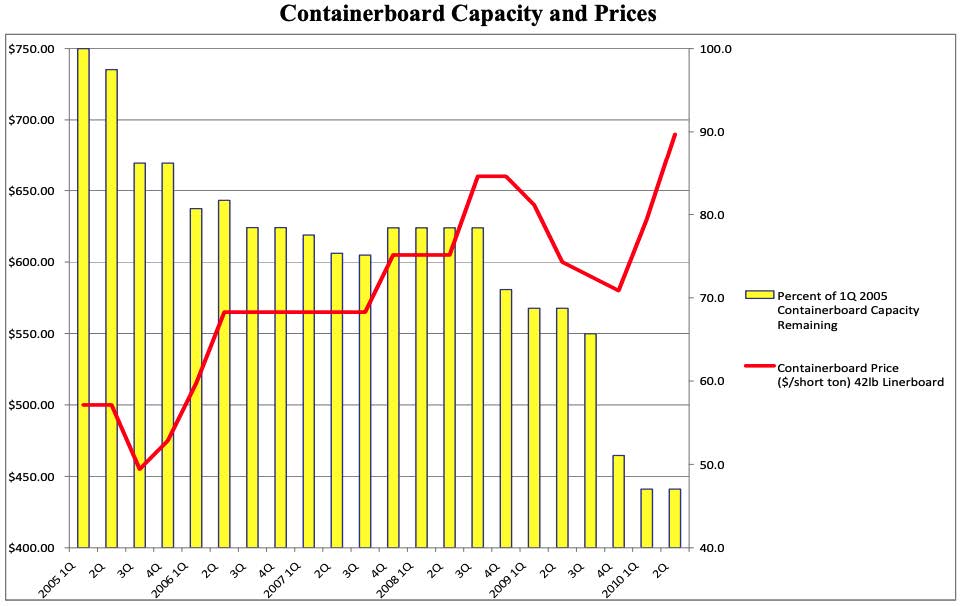

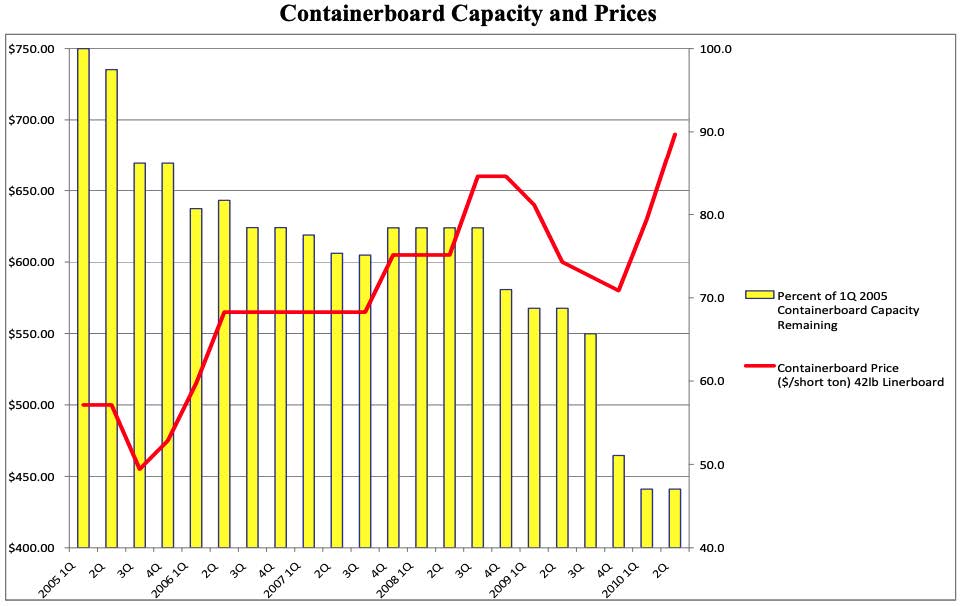

- However, the industry did experience an increase in price and decrease in output following the period in which the alleged price-fixing occurred