Market Equilibrium

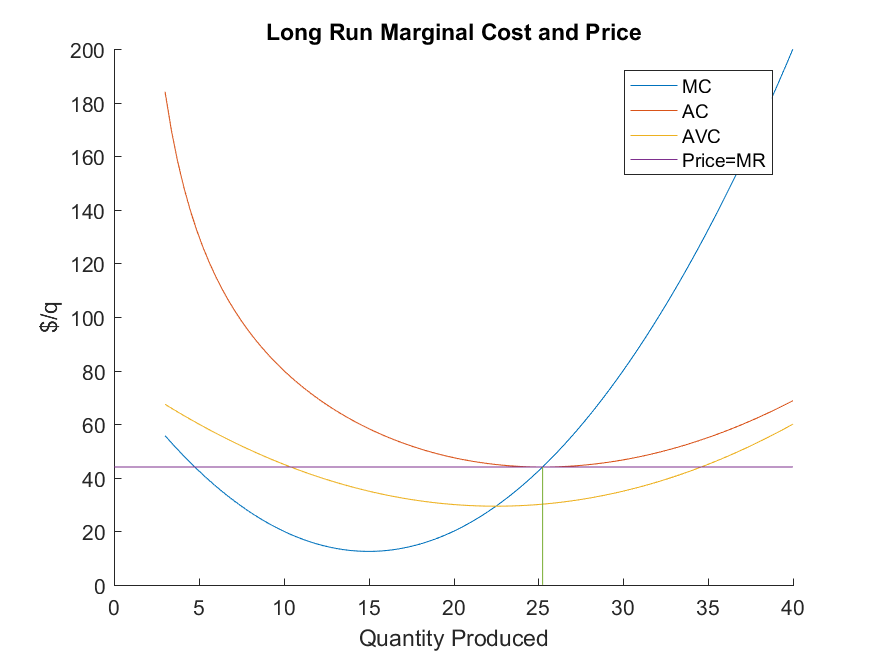

In the long run, firms in competitive markets make zero economic profit

- This requires that the market price is the minimum of the average cost curve

- Let’s consider two examples

Reaching market equilibrium: example 1

- Suppose the current market price is high enough such that all firms in the industry are

making a positive profit. This means the market price is above the lowest average cost

- Free entry allows any firm to enter the market

- Atomicity and equal access allow any single firm to make a positive profit with very little affect to the market price

- Eventually, so many firms enter the market that this competition drives the market price down until all firms earn zero profit

- When the market price creates zero profit, no new firm has incentive to enter and all active firms are indifferent between staying and leaving the market

Reaching market equilibrium: example 2

- Suppose the current market price is low enough such that all firms in the industry are

making a negative profit. This means the market price is below the lowest average cost

- Free entry allows any firm to exit the market

- Atomicity and equal access allow any single firm to make a negative profit and their exit will affect the market price very little

- Eventually, so many firms exit the market that this lack of competition drives up the market price until all firms earn zero profit

- When the market price creates zero profit, no new firm has incentive to enter and all active firms are indifferent between staying and leaving the market

- In a perfectly competitive market, the marginal revenue curve (market price) is tangent to the average cost curve at the lowest point

- More on this later today

Are perfectly competitive markets realistic?

- Not very often

- Atomicity fails when there are only a few firms

- Products are not always homogeneous (i.e. smart phones, cannabis, snowboards)

- Free entry is often violated by startup costs or exit costs (i.e. railroads, ski resorts)

- Sometimes a subset of these assumptions will hold

- The market for minimum wage jobs (workers are very similar and have no pricing power)

- The agricultural market (products are homogeneous, costs are similar)

- If these assumptions aren’t usually satisfied, then why do we care about this model?

- Perfectly competitive markets provide a useful benchmark

- From the perspective of an economist,

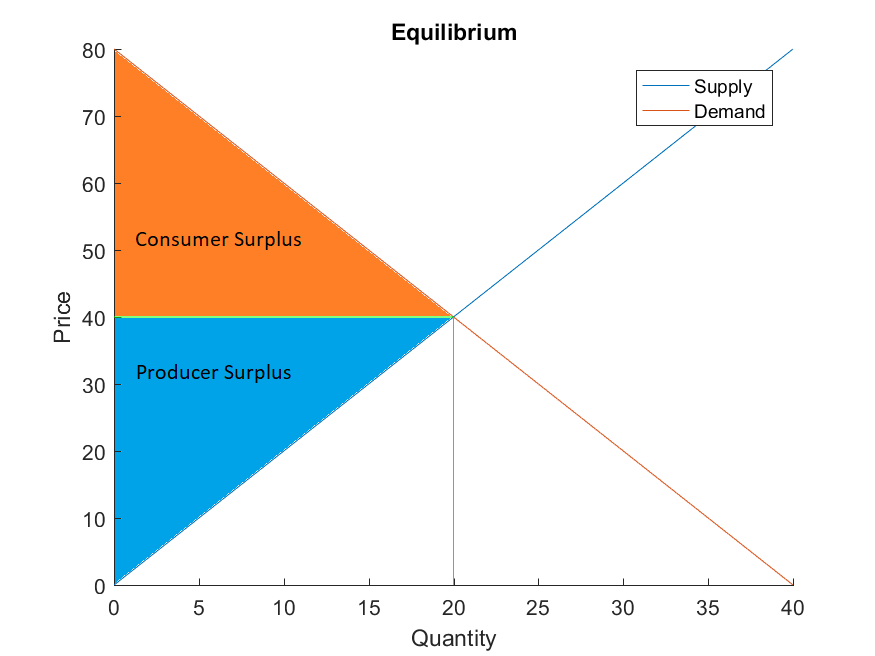

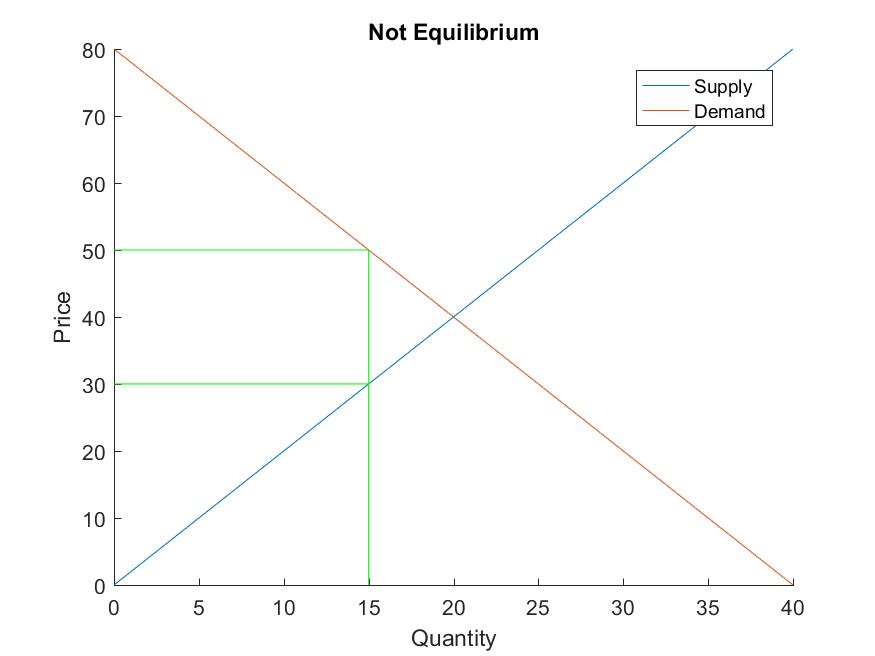

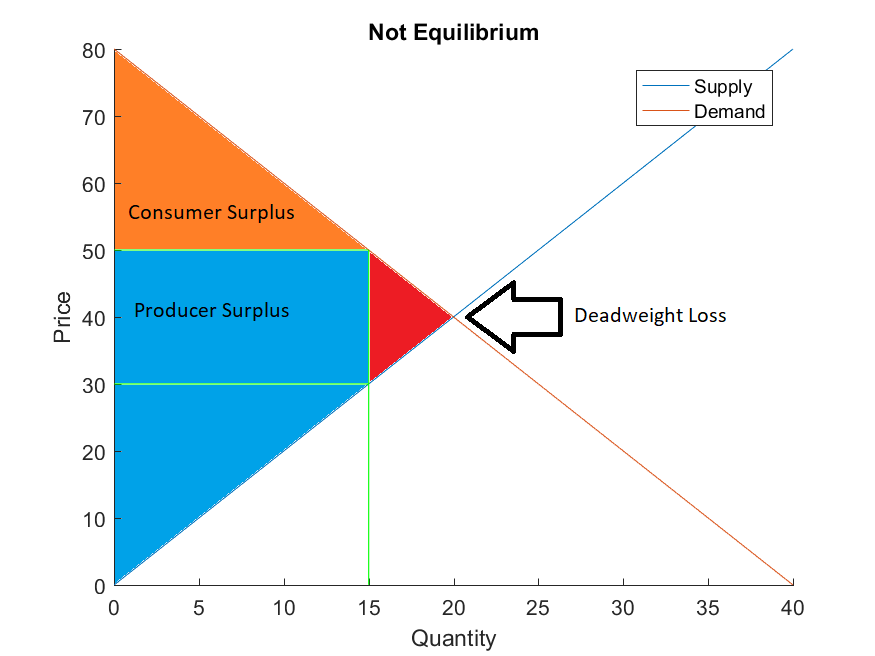

- Perfectly competitive markets (theoretically) eliminate deadweight loss

- Deadweight loss is welfare that could be collected by society, but is not collected

- This is a market inefficiency

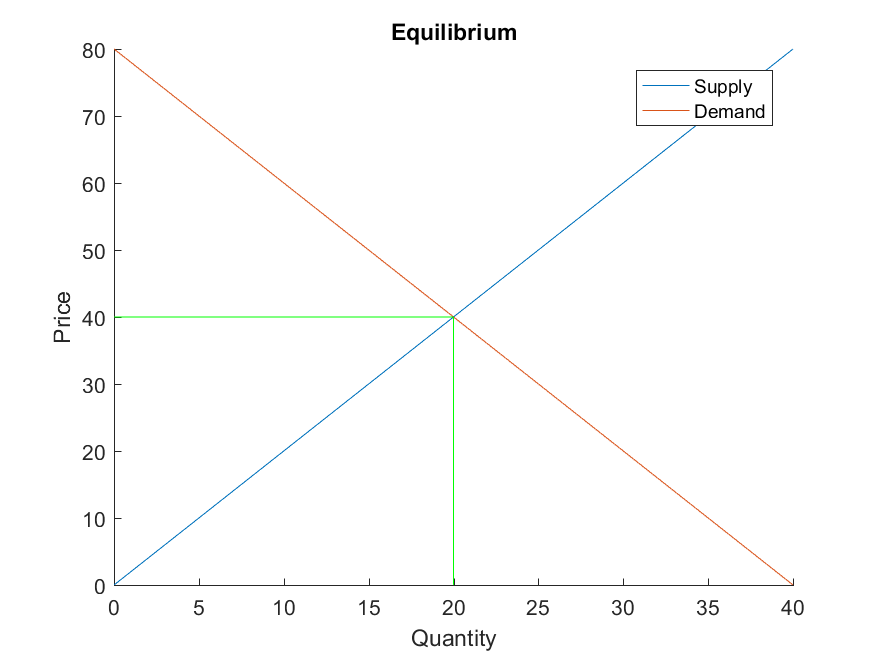

- In order to formalize a measure of deadweight loss, we need to first discuss consumer surplus and producer surplus