Monopolist’s profit maximization

Simple example

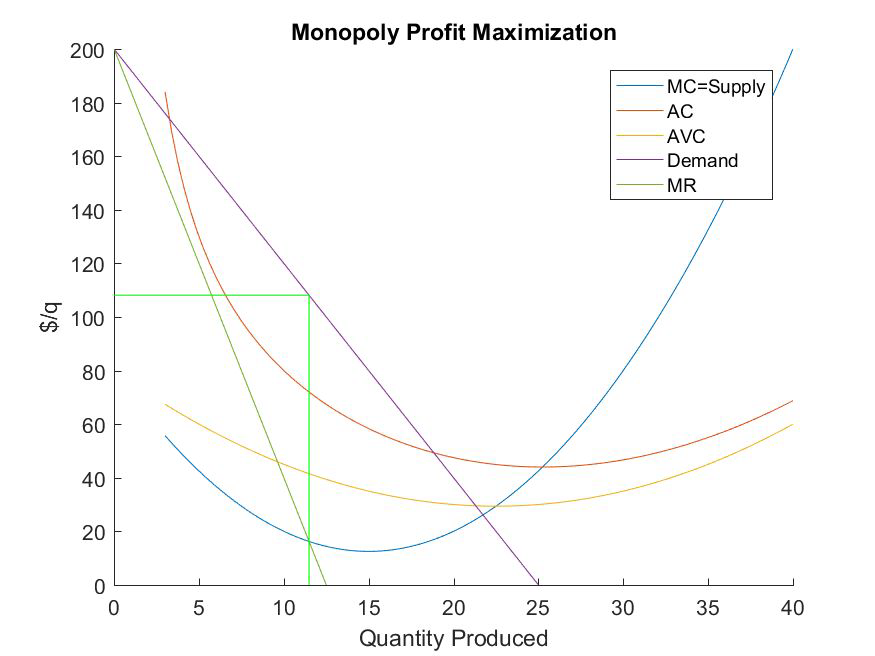

Profit maximization, regardless of market power, always occurs where marginal revenue equals marginal costs

\[ MR=MC \]

The defining feature of a monopoly is that they are the only supplier in the market. This implies they are a price-setter. Demand reacts to the price chosen by the monopolist

\[MR\neq P\]

Hence, the marginal revenue function (and total revenue function) for a monopolist is different than that of a perfectly competitive firm:

\[ TR(q)=p(q)\cdot q \\ MR(q)=p'(q)\cdot q + p(q), \]

- where \(p(q)\) is the maximum price the market will pay if \(q\) units were put up for sale,

- \(p(q)\) is referred to as the inverse demand function.

Profit maximization by a monopolist follows the basic process:

- Find \(q_m\) such that \(MR=MC\)

- Set price \(p_m= p (q_m)\)

Suppose inverse demand and total cost for a monopolist are given by the following functions:

\[ \begin{aligned} p(q)&=100-q\\ TC(q)&=100+q^2 \end{aligned} \]

Then the total revenue function can be found as such:

\[ \begin{aligned} TR(q) &=p(q)\cdot q \\ &=100q-q^2 \end{aligned} \]

Important Trick → with a linear demand function, the marginal revenue function for a monopolist always has the same intercept as demand with twice the slope

\[ MR(q)=100-2q \]

Now we’re ready to solve for the profit maximizing price and level of output for the monopolist:

\[ \begin{aligned} MR(q) &=MC(q)\\ 100-2q &=2q \\ 100 &=4q \\ 25 &=q_m \end{aligned} \]

After finding the profit maximizing quantity, we plug \(q_m\) into the inverse demand equation to find the price consumers are willing to pay:

\[ p(q_m=25) = 100-25=75 \]

Another example with implications

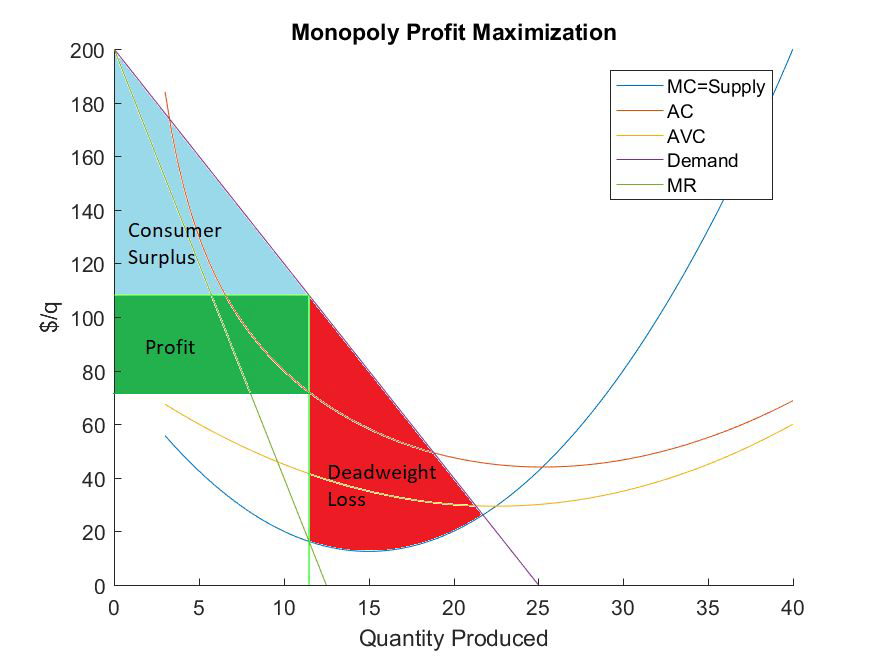

The profit maximizing level of output is the quantity that equates marginal revenue and marginal cost:

- Firms then exploit their market power by pricing according to the consumers’ maximum willingness to pay at that quantity

- Graphically, at the profit maximizing quantity, firms move up to the demand curve to set the price

- The result is a lot of deadweight loss!

- From a social welfare perspective, this outcome is economically inefficient.