Types of Price Discrimination

- Price discrimination is the act of selling the same product at two or more prices

- Intuitively, this means charging two different prices for the same good

- Mathematically, price discrimination is present if \[ \frac{P_1}{MC_1} \neq \frac{P_2}{MC_2}, \] where the subscripts denote two separate markets, consumers, etc.

- Economic definition vs legal definition

First-degree price discrimination (perfect price discrimination)

- Assume that a monopolist has perfect information about every consumer

- A firm prices the good exactly at each consumer’s willingness to pay

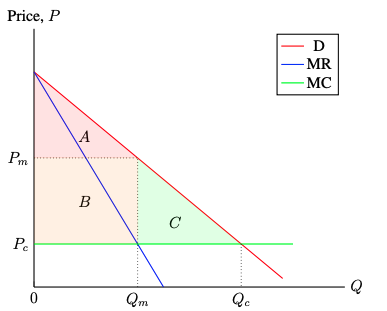

- Under perfect competition,

- Consumer surplus = A+B+C

- Producer surplus = 0

- Under monopoly,

- Consumer surplus = A

- Producer surplus = B

- Deadweight loss = C

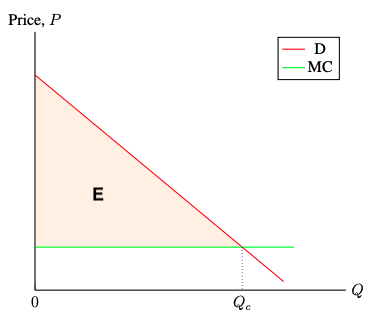

- Under perfect price discrimination,

- Consumer surplus = 0

- Producer surplus = E

Second-degree price discrimination

- Assume that a monopolist has limited information about consumers about their reservation prices

- Second-degree price discrimination is often associated with quantity discounts

- All consumers are offered the same price schedule, and they self-select into different price categories

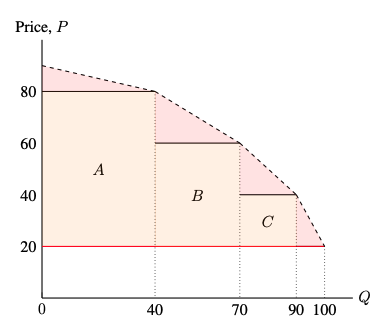

Suppose that Ralph Lauren produces a pair of designer jeans and sell them with quantity discounts.

- MC=AC=$20

- A consumer pays $80, $60, $40, and $20 for the first, the second, the third and the fourth jeans that they buy.

- Suppose 10 consumers buy in each of the four price categories

- 10 consumers bought just one pair of jeans

- 10 consumers bought two pairs of jeans

- 10 consumers bought three pairs of jeans

- 10 consumers bought four pairs of jeans

- This means that 100 pairs of jeans were sold in total, 40 of them sold at $80, 30 of them sold at $60, 20 of them sold at $40, and 10 of them sold at $20.

- In this example,

- Consumer surplus will be the summation of the red shaded regions

- Producer surplus will be 4000 (A+B+C)

- However, depending on the price schedule set by the producer, the welfare implication is not clear

- The second degree price discrimination could improve or reduce welfare compared with a uniform price policy

Third-degree price discrimination

- Suppose a monopolist sells its output in two separate markets with distinct demand curves

- This causes the monopolist to make two decisions in order to maximize profits:

- How much total output to produce

- How much of that output to sell in each market

- Once these decisions have been made, prices will be set in the two markets according to their respective demands.

Under these conditions, the firm’s total profit is given by \[ \Pi = P_1Q_1+P_2Q_2-TC(Q), \] where \(Q=Q_1+Q_2\) To maximize profit, we are solving for the following optimization problem of \[ \max_{Q_1, Q_2} \Pi \] This implies that \[ \begin{aligned} \frac{\partial \Pi}{\partial Q_1} &=MR_1 - MC =0 \\ \frac{\partial \Pi}{\partial Q_2} &=MR_2 - MC =0 \end{aligned} \] With these conditions, we have \[ MR_1= MR_2 = MC \]

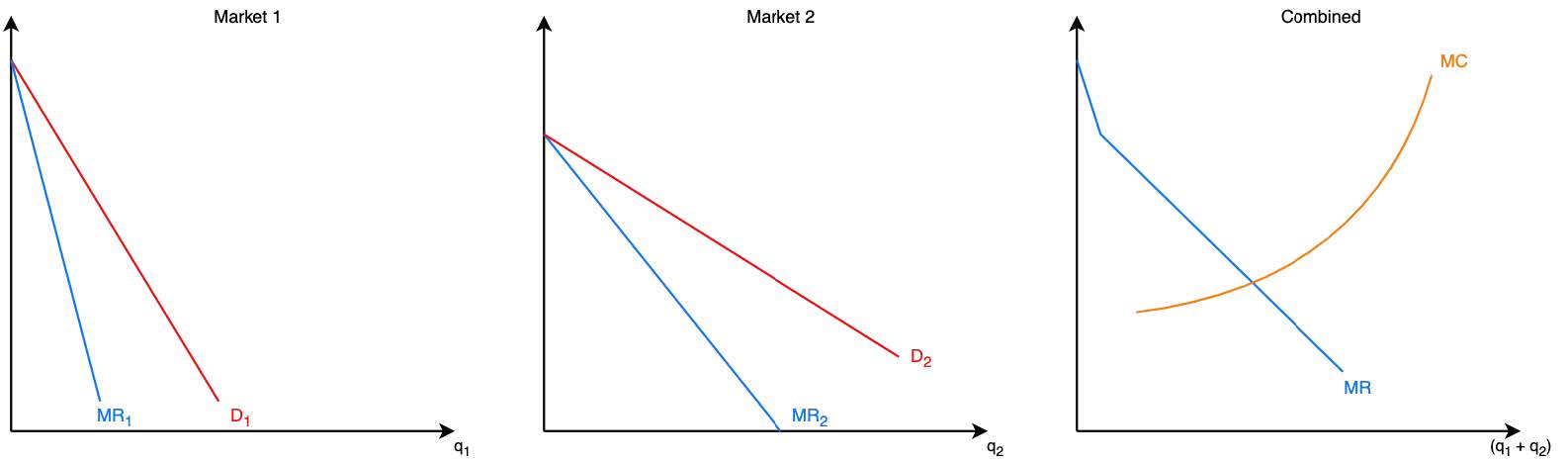

- We have three separate graphs: market 1, market 2, and the combination of both markets

- The marginal revenue curves are summed horizontally to get a MR curve in terms of \((q_1 + q_2)\)

- It’s important to note that increasing q in either market 1 or 2 will cause an increase in the total MC. Hence, we will optimize in the combined market \((Q^* = q_1^* + q_2^*)\) and determine \(q_1\) and \(q_2\) after.

- Q is determined by the point where \(MR_1 = MR_2 = MC\)

- Markets 1 and 2 produce output their respective marginal revenue is equal to the marginal cost.

- The market with less elastic demand is able to charge a higher price → price discrimination

- Recall, the more elastic the demand curve, the more consumers are responsive to a change in price

Claim: if a firm price discriminates between two markets, the market with more inelastic demand will necessarily be charged a higher price

- Based on the optimal strategy for profit maximizing monopolist, they produce the quantity where \(MC=MR\) \[ \begin{aligned} MR&=P\left(1-\frac{1}{|\eta|}\right) \end{aligned} \]

- Generalizing our optimality condition to two separate markets, a price-discriminating monopolist sets \(MC=MR_1=MR_2\) \[ \begin{aligned} P_1\left(1-\frac{1}{|\eta_1|}\right) = P_2\left(1-\frac{1}{|\eta_2|}\right) \end{aligned} \]

Solving for Optimal Production

- A firm with market power in multiple markets where the costs of production are the same is maximizing profits when the following condition holds: \[ MR_1 = MR_2 = MC \]

Suppose a firm holds a monopoly in two separate markets. The distinct inverse-demand functions for both markets are given below: \[ \begin{aligned} P_1 &= 96-3q_1 \\ P_2 &= 64-q_2 \end{aligned} \]

Production for the two separate markets is done from a central location so marginal costs are the same for producing in both markets: \[ MC = 0.5(q_1 + q_2) -16 \]

Assuming the firm is profit-maximizer, what will the output and pricing combinations for the two distinct markets \((q_1^*, q_2^*, P_1^*, P_2^*)\)?

Step 1: Find \(MR_1\) and \(MR_2\) \[ \begin{aligned} MR_1 &= 96-2\cdot 3q_1 = 96-6q_1 \\ MR_2 &= 64-2\cdot1q_2 = 64-2q_2 \end{aligned} \]

Step 2: Set \(MR_1=MR_2\) and solve for \(q_2\) as an equation for \(q_1\) (or vice versa)

\[ \begin{aligned} MR_1 &=MR_2 \\ 96-6q_1 &= 64-2q_2\\ 2q_2 &= 6q_1 - 32 \\ q_2 &= 3q_1 -16 \end{aligned} \]

Step 3: Plug your equation for \(q_2\) into the marginal cost function and simplify so it’s in terms of \(q_1\)

\[ \begin{aligned} MC &= 0.5(q_1+ q_2)-16 \\ &= 0.5(q_1+3q_1 -16) -16 \\ &= 2q_1 -24 \end{aligned} \]

Step 4: Set \(MR_1=MC\) and solve for \(q_1^*\)

\[ \begin{aligned} MR_1 &= MC\\ 96-6q_1&=2q_1-24\\ 8q_1&=120\\ q_1^*&=15 \end{aligned} \]

Step 5: Plug \(q_1^*\) into \(q_2\) equation we found in step 2 to find \(q_2^*\)

\[ \begin{aligned} q_2^\ast&=3q_1^\ast -16\\ &= 3\cdot 15 - 16 \\ &=29 \end{aligned} \]

Step 6: Plug \(q_1^*\) and \(q_2^*\) into inverse-demand functions to find the prices charged in each market

\[ \begin{aligned} P_1^\ast&=96-3q_1^* \\ &= \$51 \\ P_2^\ast&=64-q_2^* \\ &= \$35 \\ \end{aligned} \]

Final Answer:

\[ \begin{aligned} (q_1^\ast, P_1^\ast) &= (15, \$51) \\ (q_2^\ast, P_2^\ast) &= (29, \$35) \\ \end{aligned} \]