DOJ and FTC Horizontal Merger Guidelines

- The DOJ and FTC detailed how to define a market both geographically and in the same product space in their merger guidelines (1992)

- The guidelines consider the substitutability of both sellers and buyers, thus we will consider four separate measures:

- Geographic Demand Substitutability

- Geographic Supply Substitutability

- Product Demand Substitutability

- Product Supply Substitutability

Geographic Space: Demand-Side

Let’s define a geographic market for buyers

- Choose a relatively small geographic area

- Suppose all producers in the area simultaneously raise their prices

- Will buyers in that area leave to purchase the good somewhere outside of the boundary, thus making the price hike unprofitable?

- If the buyers leave: expand the area and repeat steps (2) and (3)

- If the buyers stay: then this is the geographic market for buyers

Intuitively, we are finding the largest area that consumers are willing to travel to buy goods.

Example: Suppose all dealers in Eugene were to raise prices simultaneously. If buyers decide to go to Springfield for alternative option to buy their cars, then the initial price increase in Eugene might end up not profitable. If that is the case, the geographical market should be expanded to include both Eugene and Springfield. The relevant geographical market should be broadened until demand substitutability is low enough that such small but significant price increase initiated by the hypothetical cartel becomes profitable.

Geographic Space: Supply-Side

Let’s define a geographic market for sellers

- Choose a relatively small geographic area

- Suppose all producers in the area simultaneously raise their prices

- Will firms outside of the area undercut you, thus making the price hike unprofitable?

- If firms undercut you: expand the area and repeat steps (2) and (3)

- If firms do not undercut you: this is the geographic market for buyers

Intuitively, we are finding the largest area that a firm can profitably sell their goods.

Example: Suppose all apple producers in Washington decides to raise the price of apples to Washington consumers. If apple producers from Oregon and other states decide to supply apples to Washington consumers, the overall supply of apples in Washington state will increase, driving the price down to the competitive level. Then the initial price increase might end up not profitable (price at competitive level and decrease in sales). The relevant geographical market definition should be broadened until supply substitutability is low enough that such small but significant price increase initiated by the hypothetical cartel becomes profitable.

Evidence of Geographic Markets

The DOJ accepts several different types of evidence on geographic boundaries:

- Shipment patterns of firms in the area

- Evidence of buyers having actually considered shifting their purchases among sellers at different locations, especially evidence coming from price changes

- Price movements of similar products, which cannot be explained by the cost of inputs, income, or other geographic variables

- Transportation costs

- Cost of local distribution

- Excess capacity of firms outside the area

Product Space: Demand-Side

Let’s define a product market for buyers

- Choose a single good

- Suppose all producers of that product simultaneously raise their prices

- Will buyers choose to purchase a different good, thus making the price increase unprofitable?

- If buyers purchase a different good: expand the boundary to include the substitutes and repeat steps (2) and (3)

- If buyers do not purchase a different good: this is the relevant product market for buyers

Example: Suppose all sellers of Wendy’s hamburgers agreed to raise price. Consumers might switch to McDonald’s or BurgerKing or other hamburgers. Then the relevant product market should be expanded to include these close substitutes.

Product Space: Supply-Side

Let’s define a product market for sellers

- Choose a single good

- Suppose all producers of that product simultaneously raise their prices

- Will providers of a similar good be able to undercut the original good, thus making the price hike unprofitable?

- If they undercut the good: expand the boundary to include the substitutes and repeat steps (2) and (3)

- If they don’t undercut the good: this is the relevant product market for buyers

Example: Suppose that all construction companies specializing in commercial building projects agreed to increase price. Consequently, this might induce other construction companies that specialize in residential building participate in bidding for commercial building projects. If so, then the relevant product market should be expanded to include them.

Evidence of Product Markets

The DOJ accepts several different types of evidence on product markets:

- Evidence of buyers’ perceptions of the similarity of products, particularly if buyers have contemplated switching between products due to price

- Similarities or differences in price movements over time that cannot be explained by costs, inputs, income, or other product variables

- Similarities or differences in product usage, design, composition, or other technical characteristics

- Evidence of sellers’ perceptions of the substitutability of products, particularly if the perceptions influenced business decisions

- U.S. guideline suggests that demand substitution play the major role in defining relevant market. Supply substitutability might be useful for identifying and measuring the scale of potential competitors within that market.

“Market definition focuses solely on demand substitution factors. The responsive actions of suppliers are also important in competitive analysis.” (DOJ and FTC, Horizontal Merger Guideline)

The Law of One Price

The “law of one price” states that the active sellers of the same goods must sell the same products at the same price. The equilibrium is when all active sellers sell at the same price and split the market share equally.

- If two goods are perfect substitutes, the law of one price suggests they should share the same price and only differ by the difference in transportation costs. (existence of arbitrageurs)

- Similarities in prices may indicate that they are close substitutes

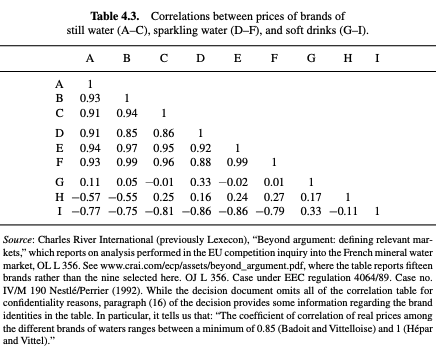

- Example: Nestle-Perrier merger

- Market for still water vs. market for water, market for nonalcoholic drinks