Market Division

- Market division is a form of collusion where multiple firms agree to only sell in agreed upon geographic territories. This gives each colluding firm a local monopoly in each geographic market.

- Three reasons firms may want to engage in market division instead of price fixing:

- Circumvent the incentive to cheat: Price fixing requires cooperation while “cheating” a market division scheme is much less of a threat

- Avoid the unequal costs problem: When firms face different costs to produce, there will never be a single agreed upon price. Market division enables firms to set their own optimal price.

- Avoid nonprice competition: With equal prices, firms will still compete in other ways (quality of product, advertising, special services). Assuming no geographic mobility between markets, there won’t be any nonprice competition for firms engaging in market division

- Consider two different firms that operate in two separate geographic locations: A and B

- Imagine they agree to engage in market division.

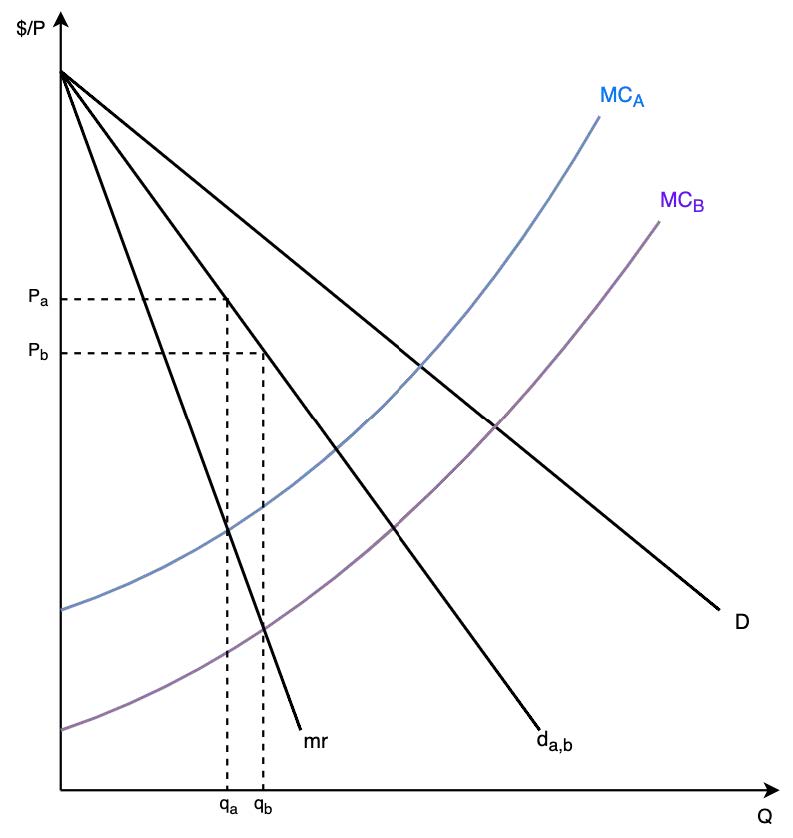

- After segmenting the market, each firm faces local demand \(d_{a,b}\)

- Each firm will act optimally (mr = MC) as a monopolist in their local market

- The firm operating in market A will produce \(q_a\) and set price \(P_a\) (the firm operating in market B will produce \(q_b\) and set price \(P_b\))

- The less efficient firm (the one with higher costs) will charge more and produce less

Threats to Market Division

There are three primary issues to note when looking at market division as a viable threat:

- There is still incentive to cheat. In our previous example, the firm with lower costs (B) could break the agreement and supply to firm A’s market for the lower price, \(P_b\)

- For market division to be successful, firms must be able to prevent arbitrage among the consumers

- Last, in this equilibrium, industry profits are not being maximized.

Enforcement

- United States v. Addyston Pipe & Steel Co. (1898)

- First application of the Sherman Act to an instance of market division

- Six southern cast iron pipe manufacturers dominated the market because none of their competitors in New England could afford to ship into their market because of high freight cost

- The six firms allocated certain cities among themselves in an effort to support local monopolies

- The firms were found to be in violation of the Sherman Act due to the fact that market division served to promote the producers’ goal of earning monopoly profits

- US v. Topco Associates, Inc. (1972)

- Topco is an association of 25 small medium sized supermarkets operating in 33 states

- Topco procured more than 1000 items to carry Topco-owned brand names

- Topco members were designated with exclusive territory

- Up until this point, decisions on market division cases were not pure per se rulings

- Following a guilty verdict, this case set precedent that market division is a per se violation of Section 1 of the Sherman Act