Predatory pricing

- Predatory pricing: the act of setting a price below cost to force competitors to exit a market

- A large, dominant firm enters a market with a smaller firm

- The large firm starts to cut prices low enough that both firms sustain losses

- The smaller firm can’t sustain the losses and exits the market

- The larger firm, now a monopolist, raises prices in the market, and threatens to slash prices again if another firm enters

- This result relies on several conditions

- The large firm must have some significant market power

- The large firm must have enough excess profit to sustain some temporary loss

Conditions to rationalize predatory pricing

- Several demanding conditions must be met in order to make predatory pricing a rational strategy

- The ``predator firm” must enjoy some threshold of market power, so that they may sufficiently affect the price

- Exit barriers (sunk costs) must be low enough that ``prey firms” can exit the industry easily

- Entry barriers must be high enough that firms cannot easily re-enter the market after the predator firm raises prices

Empirical evidence of predatory pricing

- Although allegations of predatory pricing are common, very few antitrust cases have found the defendant guilty

- Predatory pricing is hard to prove, resulting in a misallocation of judicial resources

- Potential conviction of innocent firms could discourage competitive pricing

Areeda Turner rule

- Phillip Areeda and Donald Turner turned to the relationship between a firm’s prices and costs as a more precise method of identifying predatory pricing.

- Not all “below-cost” pricing is predatory

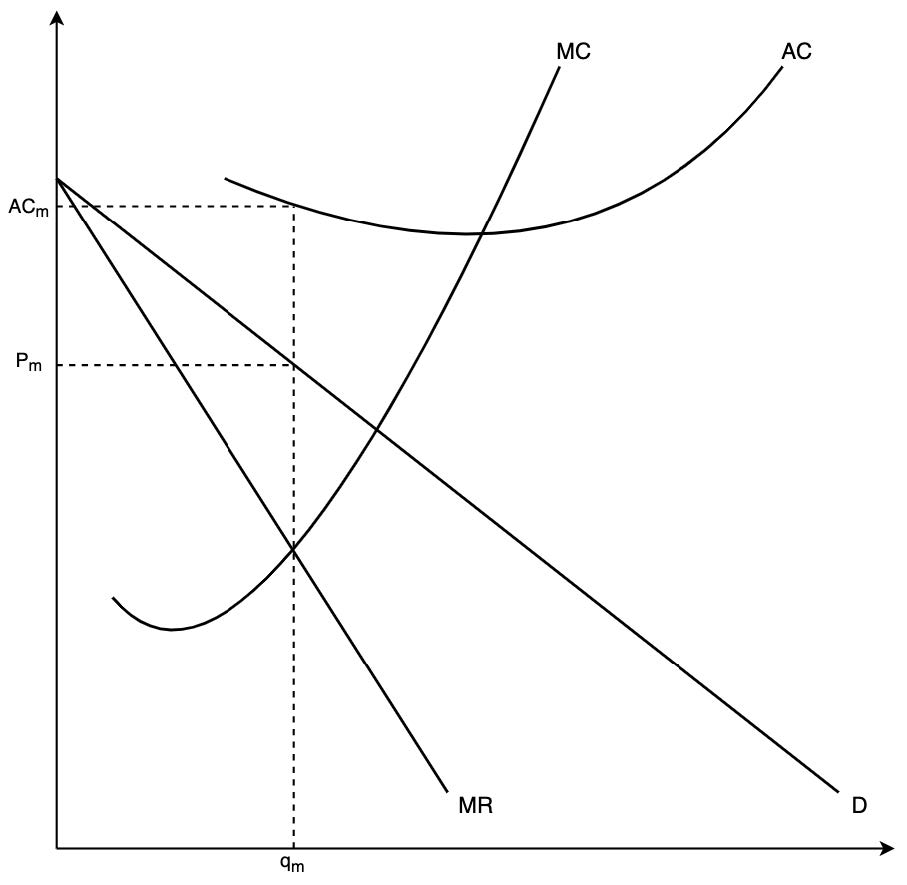

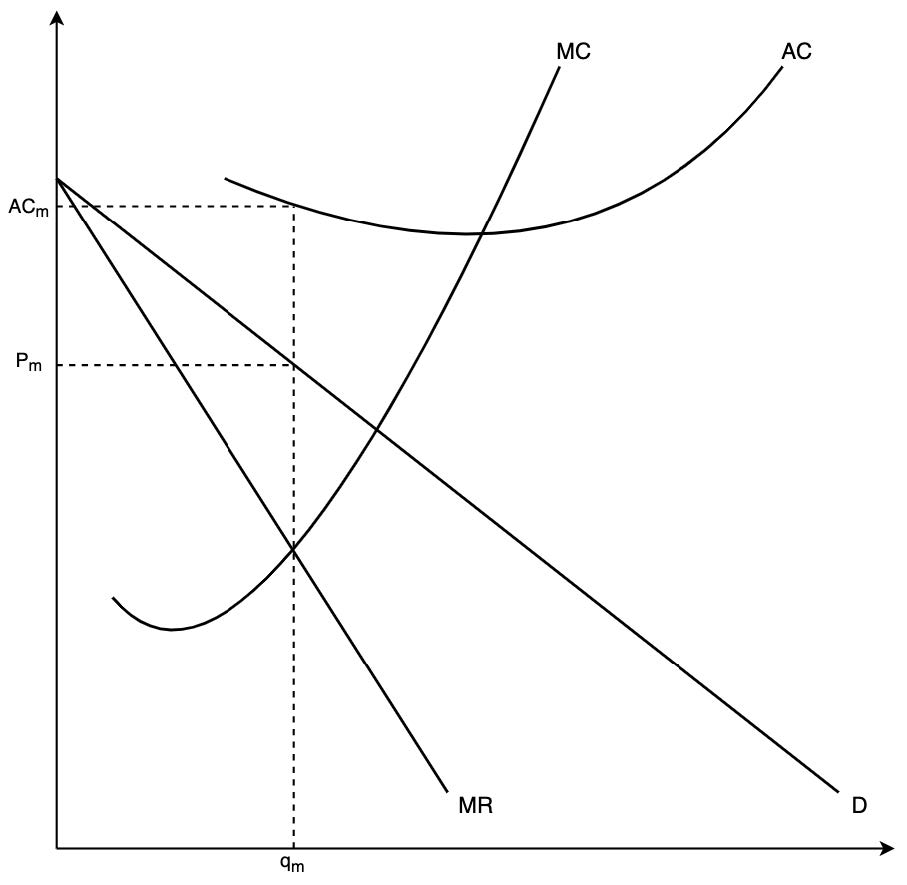

- Consider the following market:

- Suppose that \(AC\) denotes average total cost (\(ATC\)).

- For the monopolist, profit maximization occurs at an output of qm where \(MC = MR\)

- Setting the price according to demand leads to \(P_m\)

- Notice that price is below average cost (\(AC_m > P_m\)). However, it’s NOT predatory because the firm is still profit-maximizing in the short-run

- Note that if \(P_m\) is greater than or equal to \(AVC_m\), then the firm is better off producing than not produce at all

- \(AVC_m\) denotes the monopolist average variable cost, and \(FC_m\) denotes the monopolist’s fixed cost

- Profit if not produce:

\[\Pi_{\text{not produce}}=(P_m-AVC_m)q_m - FC = (P-AVC)\cdot 0 - FC = 0 - FC = -FC\]

- Profit if produce when \(P_m \geq AVC_m\):

\[

\begin{aligned}

\Pi_\text{produce}&=(P_m-AVC_m)q_m - FC \geq -FC= \Pi_{\text{not produce}}

\end{aligned}

\]

- Therefore, even if \(AC_m > P_m\) and firm could have an incentive to produce when \(P \geq AVC\), and this is not considered predatory

- Hence, we can’t label all prices below average total cost as predatory.

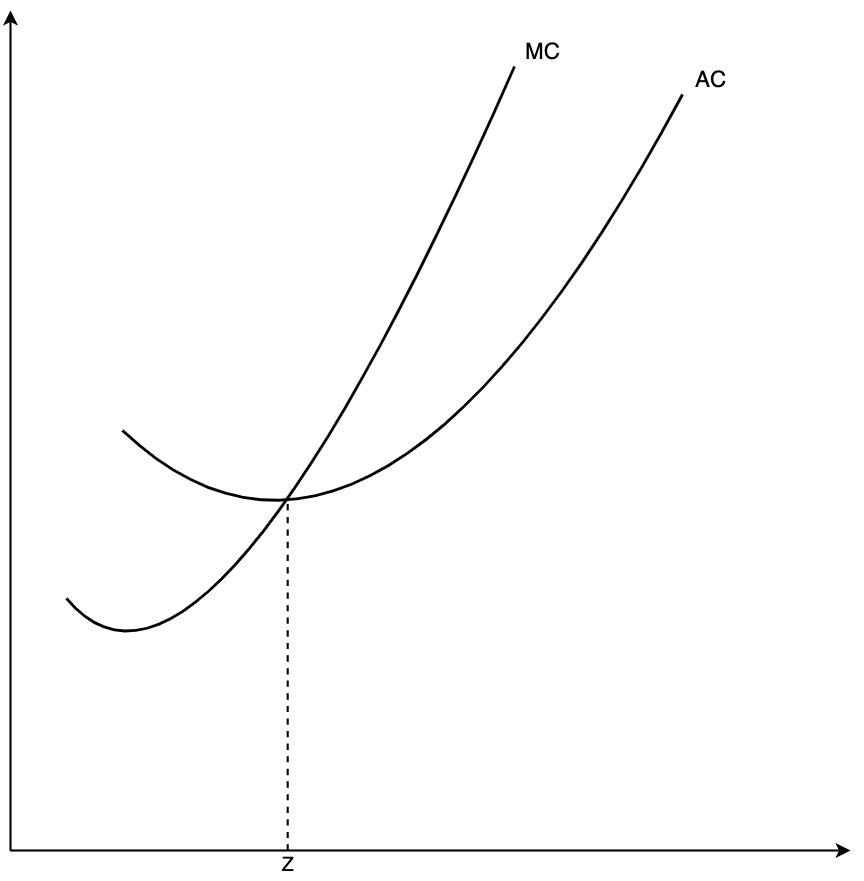

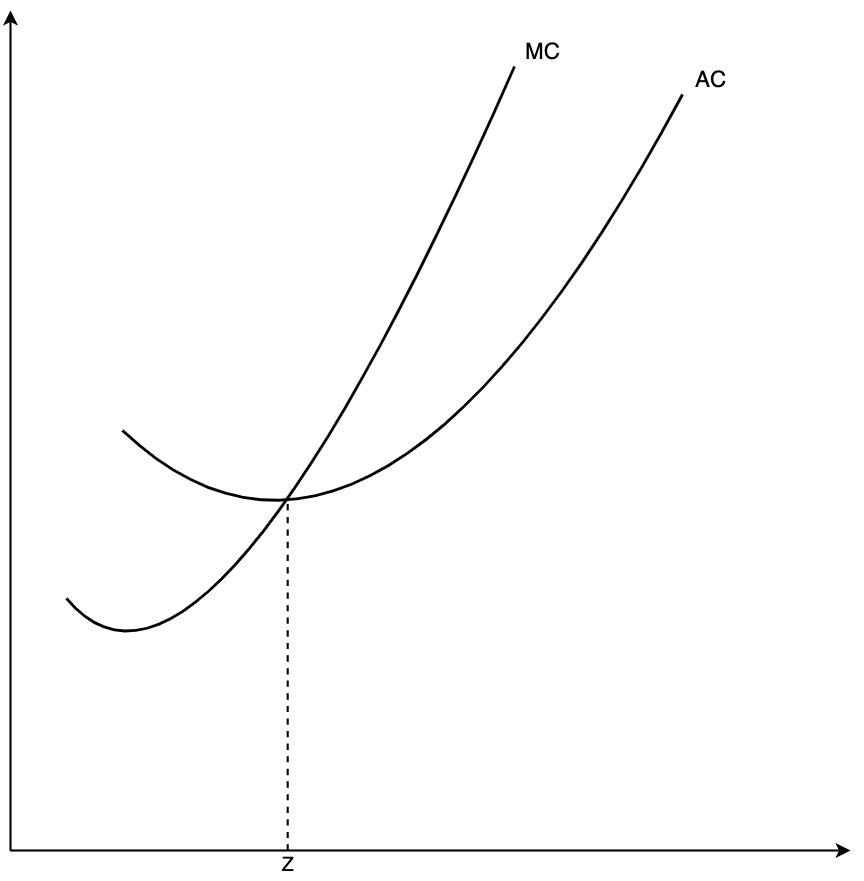

- Calculate a firm’s average total cost (ATC) and marginal cost (MC)

- If the price charged by the firm is less than both ATC and MC, then the firm is engaging in predatory pricing

- It is often difficult to obtain data on marginal cost let alone the functional form of total cost, thus Areeda and Turner suggested a practical alternative – any price below average variable cost is predatory